The manufacturing PMI rose to 49.2% in November, with the sector's exports stabilizing

The new export order indices for the four major manufacturing sectors as well as large, medium, and small enterprises all rose month-on-month.

As steady growth policies continue to take effect and positive outcomes were achieved in the China-U.S. economic and trade talks at the end of October, the National Bureau of Statistics (NBS) announced on November 30 that China's Manufacturing Purchasing Managers' Index (PMI) for November stood at 49.2%, up 0.2 percentage points from the previous month.

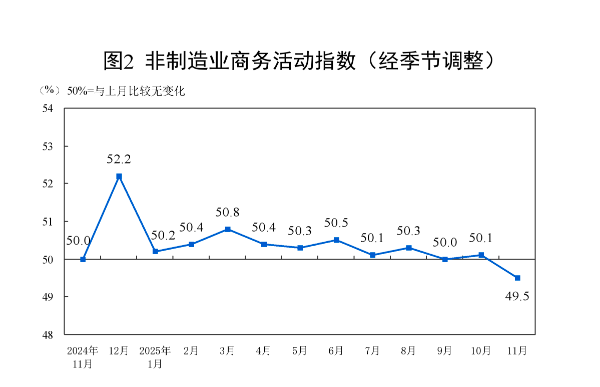

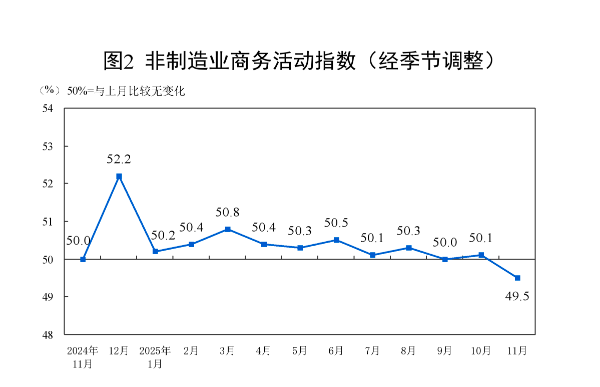

Affected by the high base effect of the Golden Week holiday last month, consumer-related service sector activities showed a seasonal decline. In November, the Non-Manufacturing Business Activity Index was 49.5%, down 0.6 percentage points month-on-month. The Composite PMI Output Index was 49.7%, a decrease of 0.3 percentage points from the previous month.

Zhang Liqun, a special analyst at the China Federation of Logistics and Purchasing (CFLP), noted that the slight recovery of the manufacturing PMI in November indicates improved market confidence. "The inspiring development goals of the 15th Five-Year Plan have had a positive impact on market sentiment. However, it is noteworthy that the manufacturing PMI remains below the boom-bust line, with demand contraction driven by market factors still prominent and the economy facing downward pressure."

Zhang emphasized the need to further strengthen counter-cyclical adjustments of macroeconomic policies around the sound start of the 15th Five-Year Plan, significantly expand government investment in public goods and services, effectively drive growth in corporate orders, and quickly reverse the trend of market-driven demand contraction.

Despite the complex international economic environment, the consensus reached on key outcomes in China-U.S. economic and trade consultations improved China's foreign trade environment in November, with manufacturing exports stabilizing. The New Export Order Index rose 1.7 percentage points month-on-month to 47.6%, a notable increase. Stabilized exports drove a partial recovery in overall manufacturing market demand, with the New Order Index climbing 0.4 percentage points to 49.2%.

Wen Tao, an expert at the China Logistics Information Center, stated that November's manufacturing export stabilization was comprehensive: new export order indices for the four major manufacturing sectors and all enterprise sizes (large, medium, small) rose month-on-month. Specifically, the index for high-tech manufacturing surged over 3 percentage points, consumer goods manufacturing increased by more than 2 percentage points, and both large and small enterprises saw gains exceeding 2 percentage points.

Recovering demand boosted enterprises' production willingness, keeping manufacturing activities stable. The Production Index returned to the boom-bust line at 50% in November, up 0.3 percentage points from the previous month's temporary contraction.

By sector, the Production Index for equipment manufacturing, high-tech manufacturing, and consumer goods manufacturing remained in expansion territory. The index for basic raw materials manufacturing rose month-on-month, indicating steady growth in new drivers and consumer goods production, as well as a stable recovery in basic raw materials output—reflecting a coordinated and stable operation of manufacturing production.

Amid stable overall manufacturing activities, finished goods de-stocking accelerated. The Finished Goods Inventory Index dropped 0.8 percentage points to 47.3%, declining for two consecutive months, which signals smooth corporate sales.

On the price front, synchronized stabilization of supply and demand strengthened market price support. Manufacturing raw material prices rose faster, with the Purchasing Price Index increasing 1.1 percentage points to 53.6%. Driven by higher raw material costs and stabilized demand, the decline in finished goods prices narrowed: the Producer Price Index rose 0.7 percentage points to 48.2%.

Looking ahead to the manufacturing PMI trend, Wen Tao predicted that in December, all sectors will enter the year-end sprint phase, coinciding with a critical period for policy implementation and fund disbursement. Coupled with expected demand growth from the launch of the 15th Five-Year Plan and normalized import-export activities amid stabilized foreign trade, manufacturing market demand is poised for further stabilization and recovery, driving steady growth in production. Raw material prices may continue to rise steadily, while finished goods prices will tend to stabilize.

In November, the Non-Manufacturing Business Activity Index fell 0.6 percentage points month-on-month to 49.5%, indicating a slight weakening in non-manufacturing sentiment.

Affected by the fading holiday effect, the Services Business Activity Index dropped 0.7 percentage points to 49.5%. By sector, industries such as railway transportation, telecommunications, radio, television and satellite transmission services, and monetary and financial services maintained a high boom level above 55.0%, with rapid business volume growth. In contrast, real estate and residential services remained below the boom-bust line, reflecting weak market activity.

He Hui, Vice President of the CFLP, attributed the non-manufacturing slowdown mainly to the seasonal decline in consumer-related services due to the high base effect of last month's Golden Week. Business Activity Indices for sectors including retail, accommodation and catering, transportation, tourism, culture, sports, and entertainment all fell to varying degrees. He noted that concentrated demand from year-end festivals and winter consumption is expected to drive a recovery in consumer-related services.

The Construction Business Activity Index improved slightly by 0.5 percentage points to 49.6% in November. The Business Activity Expectations Index rose 1.9 percentage points to 57.9%, indicating increased confidence among construction enterprises in near-term industry development.

Wu Wei, an expert at the China Logistics Information Center, projected that accelerated progress on key year-end projects will generate substantial physical workloads. Combined with the synergistic effect of special bonds and policy-based financial instruments, investment is expected to remain resilient at year-end, underpinning steady growth.

Wu summarized that while non-manufacturing activities slowed due to the seasonal decline in consumer-related services, positive factors are emerging—including robust financial activities, sound development of new drivers, and a recovery in construction. As the year-end approaches, sustained policy support and the year-end sprint in supply and demand are expected to release investment and consumption potential, laying the foundation for a strong annual economic finish. However, he emphasized that sustained stable economic operation requires accelerated implementation of various policies to boost social expectations and fully unlock demand potential.